Auto Insurance in Illinois is a State Law

Having auto insurance is state law in most states. According to the Illinois Secretary of State, “You are in compliance with the mandatory insurance law if you have vehicle liability insurance in the following minimum amounts: $25,000 – injury or death of one person in an accident. $50,000 – injury or death of more than one person in an accident.” Plainly said, you have to have auto insurance in Illinois.

Taking your chances?…IL DMV states, “If you are convicted of driving without a valid insurance policy, you will face the following penalties: Suspension of your license plates. $500 minimum fine. $1000 minimum fine if you are caught driving a vehicle with suspended plates due to an insurance violation.” We don’t think it’s worth the risk. Not when auto insurance is affordable, in relationship to potential legal penalties and the actual coverage/protection you will get, when you do have it.

Since we are based in Illinois, we’ll keep our auto insurance advice to what we know best. When considering car insurance or if you’re looking for car insurance quotes in Chicago or the State, there are some things to know and consider up front.

Here is our top 10 Auto Insurance “Need to Know List”:

AUTO INSURANCE TOP 10

- Uninsured & UNDER-insured Motorist Coverage is IL State Law.

- Liability Insurance is IL State Law

- Illinois is a “Fault” Car Insurance State. In other words, fault is designated to a party and that party in fault must pay for damages stemming from a car accident. That means if you’re at fault, you will have to pay for everyone. Knowing this will help you determine just how much coverage you will want in case that happens, within your car insurance policy.

- Optional Coverages are that and are not required by Illinois State Insurance Law. This is, however, where you may want to consider how much you have at stake, if you get into a serious automobile accident.

- IL DMV randomly sends questionnaires to registered car owners for proof of insurance.

- You must produce proof of Illinois Auto Insurance during a traffic stop and must have your auto insurance card in your car, always.

- In the first 60 days, your car insurance may be CANCELLED AT ANY TIME for nearly any reason.

- After 60 days, your car insurance may only be cancelled for very specific reasons.

- When canceling your car insurance policy, your ins company is required to notify you by mail at least 10 days prior to cancellation (if you fail to pay your premium) or 30 days before cancellation for “any other reason”.

- Your car insurance company may also not renew your policy at the end of each policy cycle for the first 5 Years, for any reason except for AGE, GENDER, RACE, COLOR, CREED, ANCESTRY, CREDIT SCORE, PHYSICAL HANDICAP, EMPLOYER, MARITAL STATUS, OCCUPATION and ANCESTRY.

As usual, as much as this information was referenced through the Illinois DMV car insurance page, we invite you to visit them for more in-depth details on auto insurance in Illinois.

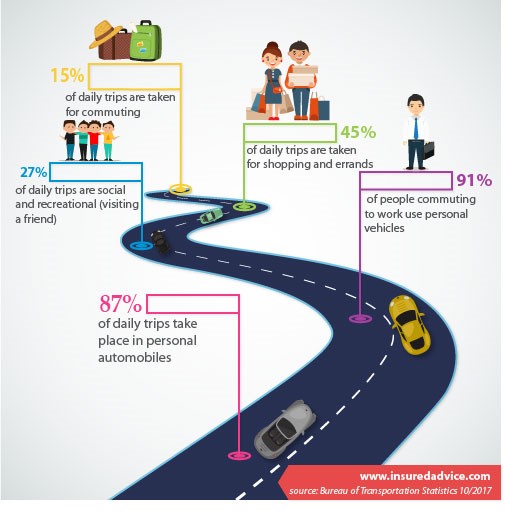

How Is Your Time Spent Behind The Wheel?

Insurance agents are here to help you navigate through your car insurance options and rates.

It really doesn’t cost anything to call and get the answers you need.

331.223.9788 – Call us for some insured advice.

IGNORANCE IS NOT BLISS, BUT BLISS COMES FROM KNOWLEDGE

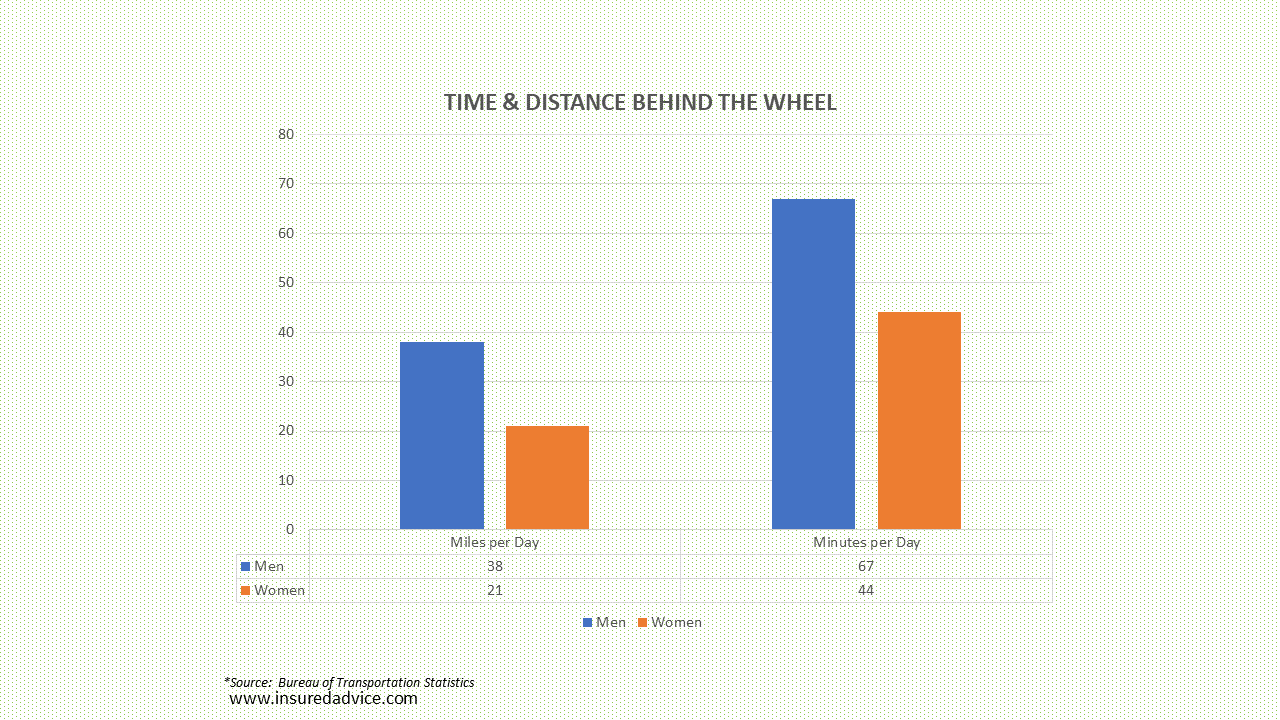

Driving Habits: Men vs Women

HERBERS INSURANCE – AUTO INSURANCE SPECIALISTS

With 5 greater Chicago locations, Herbers Insurance specializes in Chicago Auto Insurance.

Call and get a free, no-hassle insurance quote at (331) 223-9788